Invest in London prime real estate, professionally managed for you.

Introducing fractional ownership to the world, not just a few.

iOWNio enables Asset Managers and Property Developers to

fractionalise, giving smaller investors access to prime real

estate.

The result is democratisation and equal opportunity access to

wealth.

Already have an account? Log in here

Invest in London prime real estate, professionally managed for you.

Introducing fractional ownership to the world, not just a few.

iOWNio enables Asset Managers and Property Developers to

fractionalise, giving smaller investors access to prime real

estate.

The result is democratisation and equal opportunity access to

wealth.

Already have an account? Log in here

Invest in London prime real estate, professionally managed for you.

Introducing fractional ownership to the world, not just a few.

iOWNio enables Asset Managers and Property Developers to

fractionalise, giving smaller investors access to prime real

estate.

The result is democratisation and equal opportunity access to

wealth.

Already have an account? Log in here

Invest in London prime real estate, professionally managed for you.

Introducing fractional ownership to the world, not just a few.

iOWNio enables Asset Managers and Property Developers to

fractionalise, giving smaller investors access to prime real

estate.

The result is democratisation and equal opportunity access to

wealth.

Already have an account? Log in here

Invest in London prime real estate, professionally managed for you.

Introducing fractional ownership to the world, not just a few.

iOWNio enables Asset Managers and Property Developers to

fractionalise, giving smaller investors access to prime real

estate.

The result is democratisation and equal opportunity access to

wealth.

Already have an account? Log in here

Lorem ipsum dolor sit amet, consectetur adipiscing elit 75%

THE I0WNI0 PLATFORM SUPPORTS THREE MAIN PROCESSES

The issuance process where tokenized securities are issued in order to fund- raise a project

The longer-term corporate management of a group of investors who are holding tokens to document their ownership of securities within the project

internal trading among investors via the built-in OTC marketplace

Invest in London prime real estate, professionally managed for you, with yield distributions and equity allocations fully governed via blockchain fintech.

The Tannery

Godalming, Surrey

- Project Status:

- Timeframe:

- Offering Type:

- Completed Project

- 12 months construction time

- 23 Apartments

- Target Investor IRR:

- Target Average Cash Yield:

- Targeted Equity Multiple:

- 12.1%

- 5.5%

- 1.5x

GDV

£10.1m

Minimum Investment:

£1,000

The Barns

Frensham, Surrey

- Project Status:

- Timeframe:

- Offering Type:

- Completed Project

- 15 months construction time

-

10 Barn conversions on

disused farm Inc. restored

farmhouse

- Target Investor IRR:

- Target Average Cash Yield:

- Targeted Equity Multiple:

- 13.2%

- 3.9%

- 1.87x

GDV

£17.5m

Minimum Investment:

£1,000

Castle Yard

Farnham, Surrey

- Project Status:

- Timeframe:

- Offering Type:

- Completed Project

- 12 months construction time

-

9 executive houses Opposite

Farnham Castle

- Target Investor IRR:

- Target Average Cash Yield:

- Targeted Equity Multiple:

- 14.4%

- 6.6%

- 1.88x

GDV

£9.4m

Minimum Investment:

£1,000

Holme Hill

Upton Grey, Hampshire

- Project Status:

- Timeframe:

- Offering Type:

- Completed Project

- 14 months construction time

-

10 private and 7 key worker

houses in picturesque village

- Target Investor IRR:

- Target Average Cash Yield:

- Targeted Equity Multiple:

- 17%

- 4.1%

- 1.74x

GDV

£18.2m

Minimum Investment:

£1,000

Wingate Meadow

Long Sutton, Hampshire.

- Project Status:

- Timeframe:

- Offering Type:

- Completed Project

- 14 months construction time

-

5 contemporary houses Close

to Lord Wandsworth College

- Target Investor IRR:

- Target Average Cash Yield:

- Targeted Equity Multiple:

- 15.8%

- 4.5%

- 1.94x

GDV

£10m

Minimum Investment:

£1,000

The Stables

Dockenfield, Surrey

- Project Status:

- Timeframe:

- Offering Type:

- Completed Project

- 12 months construction time

- 4 stable style new houses

- Target Investor IRR:

- Target Average Cash Yield:

- Targeted Equity Multiple:

- 15.4%

- 4%

- 1.98x

GDV

£5.1m

Minimum Investment:

£1,000

CURRENT PROJECTS

The Works

Isleworth

- Project Status:

- Timeframe:

- Offering Type:

- Current Project

- 15 months construction time

-

53 Apartments Opposite

Isleworth Station

- Target Investor IRR:

- Target Average Cash Yield:

- Targeted Equity Multiple:

- 16%

- 4.4%

- 1.86x

GDV

£24.8m

Profit

£7.4m

Minimum Investment:

£1,000

Lock up period:

6 months

Dulwich Peak

Dog Kennel Hill, London SE22

- Project Status:

- Timeframe:

- Offering Type:

- Current Project

- 15 months construction time

-

28 apartments Mix of

duplexes and 1 bed flats

- Target Investor IRR:

- Target Average Cash Yield:

- Targeted Equity Multiple:

- 12%

- 4.2%

- 1.78x

GDV

£18.5m

Profit

£4.6m

Minimum Investment:

£1,000

Lock up period:

6 months

Conyers Road & Wellfield Road

London SW16

- Project Status:

- Timeframe:

- Offering Type:

- Current - Live Now

- 12 months construction time

-

2 community buildings Total

of 24 new apartments

- Target Investor IRR:

- Target Average Cash Yield:

- Targeted Equity Multiple:

- 13.6%

- 4.2%

- 1.88x

GDV

£9.8m

Profit

£3.9m

Minimum Investment:

£1,000

Lock up period:

12 months

Leopold Court

East Finchley, London N2

- Project Status:

- Timeframe:

- Offering Type:

- Current - Live Now

- 12 months construction time

- 20 Luxury Apartments

- Target Investor IRR:

- Target Average Cash Yield:

- Targeted Equity Multiple:

- 13%

- 5%

- 2x

GDV

£14.8m

Profit

£3.8m

Minimum Investment:

£1,000

Lock up period:

3 months

Denewood Road

Highgate, London.

- Project Status:

- Timeframe:

- Offering Type:

- Current - Live Now

- 12 months construction time

-

13 apartments, each with

parking in landscaped

gardens.

- Target Investor IRR:

- Target Average Cash Yield:

- Targeted Equity Multiple:

- 8.9%

- 4.1%

- 1.68x

GDV

£29m

Profit

£9.6m

Minimum Investment:

£1,000

Lock up period:

6 months

Bridge Point

Weybridge. Surrey.

- Project Status:

- Timeframe:

- Offering Type:

- Current - Live Now

- 12 months construction time

- 51 Luxury Apartments

- Target Investor IRR:

- Target Average Cash Yield:

- Targeted Equity Multiple:

- 18%

- 4.6%

- 1.98x

GDV

£25m

Profit

£6.3m

Minimum Investment:

£1,000

Lock up period:

12 months

Charles Hill Park

Tilford, Surrey.

- Project Status:

- Timeframe:

- Offering Type:

- Current - Live Now

- 12 months construction time

-

27 Acres in prime location

5 new homes, each in

mature secluded settings

- Target Investor IRR:

- Target Average Cash Yield:

- Targeted Equity Multiple:

- 13.2%

- 4.5%

- 1.72x

GDV

£25m

Profit

£7.65m

Minimum Investment:

£1,000

Lock up period:

3 months

Dene End Farm

Haslemere, Surrey

- Project Status:

- Timeframe:

- Offering Type:

- Current - Live Now

- 12 months construction time

-

13 acres of unused farmland

and buildings

- Target Investor IRR:

- Target Average Cash Yield:

- Targeted Equity Multiple:

- 12.6%

- 4%

- 1.88x

GDV

£10m

(Phase 1)

Expanded developmentand further (Phase 2)

Profit

£3.1m (Phase 1)

£10m (Phase 2)

Minimum Investment:

£1,000

Lock up period:

6 months

Bridge Point

Weybridge. Surrey.

- Project Status:

- Timeframe:

- Offering Type:

- Current - Live Now

- 12 months construction time

- 51 Luxury Apartments

- Target Investor IRR:

- Target Average Cash Yield:

- Targeted Equity Multiple:

- 18%

- 4.6%

- 1.98x

GDV

£25m

Profit

£6.3m

Minimum Investment:

$1,000

Lock up period:

12 months

FUTURE PROJECTS

The Medburn Estate

Radlett, Hertfordshire

- Project Status:

- Timeframe:

- Offering Type:

- Future Project

- 12 months construction time

-

Planning application

for 39 Houses

- Target Investor IRR:

- Target Average Cash Yield:

- Targeted Equity Multiple:

- 15%

- 5%

- 1.96x

GDV

£34.8m

Profit

£8.7m

Minimum Investment:

£1,000

Lock up period:

12 months

Ex-Wyevale Garden Centre

Alfold, Surrey

- Project Status:

- Timeframe:

- Offering Type:

- Future Project

- 12 months construction time

- Outline consent for 78 houses

- Target Investor IRR:

- Target Average Cash Yield:

- Targeted Equity Multiple:

- 16.2%

- 4.2%

- 1.68x

GDV

£40m

Profit

£8.6m

Minimum Investment:

£1,000

Lock up period:

6 months

Wildwood Livery

Alfold, Surrey

- Project Status:

- Timeframe:

- Offering Type:

- Future Project

- 12 months construction time

- 7 new barn style houses

- Target Investor IRR:

- Target Average Cash Yield:

- Targeted Equity Multiple:

- 12.4%

- 4.2%

- 1.78x

GDV

£5.2m

Profit

£1.6m

Minimum Investment:

£1,000

Lock up period:

6 months

Bishopswood Farm

Sonning, Oxfordshire

- Project Status:

- Timeframe:

- Offering Type:

- Future Project

- 12 months construction time

- 14 houses and barn

- Target Investor IRR:

- Target Average Cash Yield:

- Targeted Equity Multiple:

- 8%

- 4%

- 1.68x

GDV

£16.7m

Profit

£5.6m

Minimum Investment:

£1,000

Lock up period:

6 months

Esher Park Gardens

Esher, Surrey

- Project Status:

- Timeframe:

- Offering Type:

- Future Project

- 12 months construction time

- 62 apartments

- Target Investor IRR:

- Target Average Cash Yield:

- Targeted Equity Multiple:

- 12.4%

- 5.6%

- 1.5x

GDV

£25m

Profit

£6.3m

Minimum Investment:

£1,000

Lock up period:

12 months

Bridge Point

Leatherhead, Surrey

- Project Status:

- Timeframe:

- Offering Type:

- Future Project

- 12 months construction time

- 28 Apartments

- Target Investor IRR:

- Target Average Cash Yield:

- Targeted Equity Multiple:

- 16%

- 4.4%

- 1.92x

GDV

£14.2m

Profit

£3.6m

Minimum Investment:

£1,000

Lock up period:

12 months

iownio BENEFITS

- Targeted Average Cash Yield 4% due to quality London assets (rental income)

- Targeted Investor IRR: 8% - 12%

- Targeted Average Equity Multiple 2x

- Minimum Investment £100

- Reliable Asset Appreciation - prime London, family dwelling newbuild.

- Housing shortage in London equals strong demand.

- Asset appreciation, increased equity is reinvested into new acquisitions to enhance your portfolio

- Highly liquid market, huge demand. You can buy and sell from anywhere with ease within minutes not weeks or months!

- Options to diversify into Development Projects for higher growth

- Additional asset classes to be considered later.

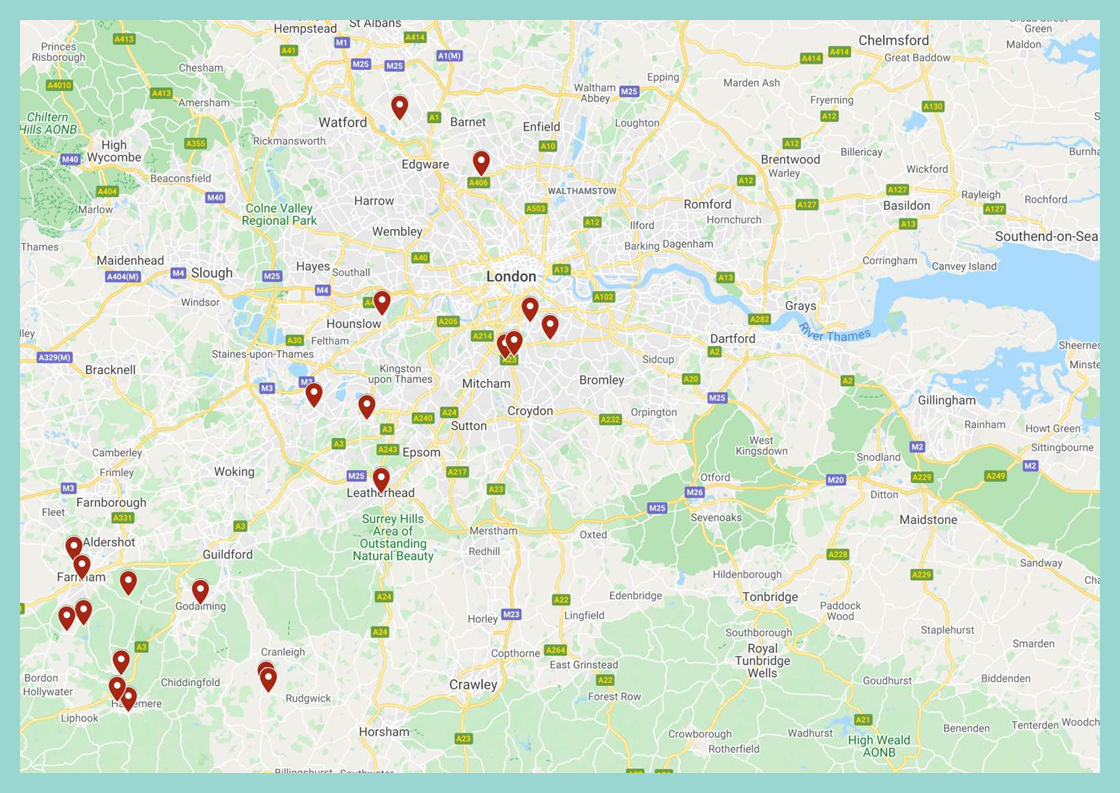

CURRENT NEW DEVELOPMENT SITE LOCATIONS

WEST OF LONDON

- Real estate is the biggest single asset class where tokenization can provide value, £228 trillion in total real estate assets worldwide.

- Only 7% of global real estate assets is available for investment. Only 3% of the global population has invested into real estate, however 80% want to invest.

- For the issuance process we support a customized on-boarding process where KYC (know your customer) and AML (anti-money laundering) options are adjusted to the specific jurisdiction of issuer and investors.

- The platform also provides an internal OTC- like (Over The Counter) trading exchange. This means that existing investors within a project can trade tokens with each other.

- Blockchain based tokenization platform.

- Supporting Real Estate Developers and Asset Managers to digitize and automate processes.

- Reaching new types of investors and enabling those investors to trade.

- Both for Asset Sales and New Development Projects.

- Real Estate backed tokens can Issued, Sold to investors or Traded on the platform.

- Extreme automation of execution, providing high efficiency and low cost.

10% of global GDP on

blockchain

- 2027 -

Tokenization market CAGR

at 59%

- 2019 - 2030 -

Europe tokenization market

£1.5 trillion

- 2024 -

Gabriel, US Business Development Associate, says...

After being exposed to private market capital raising and transactions for a few years, it seemed quite clear to me that the sector was ripe for disruption. I became interested in learning about ways in which private market investing could become more accessible, less expensive and time consuming, and offer more liquidity. This naturally led me to discover the benefits of blockchain technology and security tokenization. The more I read about it, the more I could see how it could bring massive innovation to private markets.

When I made it my goal to join a pioneer in security tokenization, DigiShares was one of the first names on my radar. They are clearly one of the very few real estate / real assets security tokenization software specialists in the world. I consider myself very lucky to be joining such an exciting company and field at an early stage.

The US is the world’s largest financial market and the epicenter of innovation, which is why I’m convinced of DigiShares’ huge potential to grow here. There are over 13M accredited investor households in the US, many of which are having most of their wealth tied to public capital markets and/or a very small number of real estate properties. DigiShares’ software has the potential to help them access diversified private market opportunities, by enabling asset managers and crowdfunding platforms to lower minimum investment requirements and helping investors access liquidity. Hopefully, in the next few years, the regulatory environment will evolve to broaden this opportunity to the whole population. That’s the future I’m excited about and I look forward to working towards it with DigiShares and their partners.

About iownio

iownio provides an exchange platform for Commercial Real Estate issuance and post-issuance management via tokenized securities.

Helps with the initial design of the security token such Dig iShares is your trusted partner to ensure that your digital shares will be compliant and liquid.

About Scott McKenzie

(scott@scottmckenz.ie)

Scott is an American lawyer who has worked with a range of blockchain startups and companies looking to raise funds.